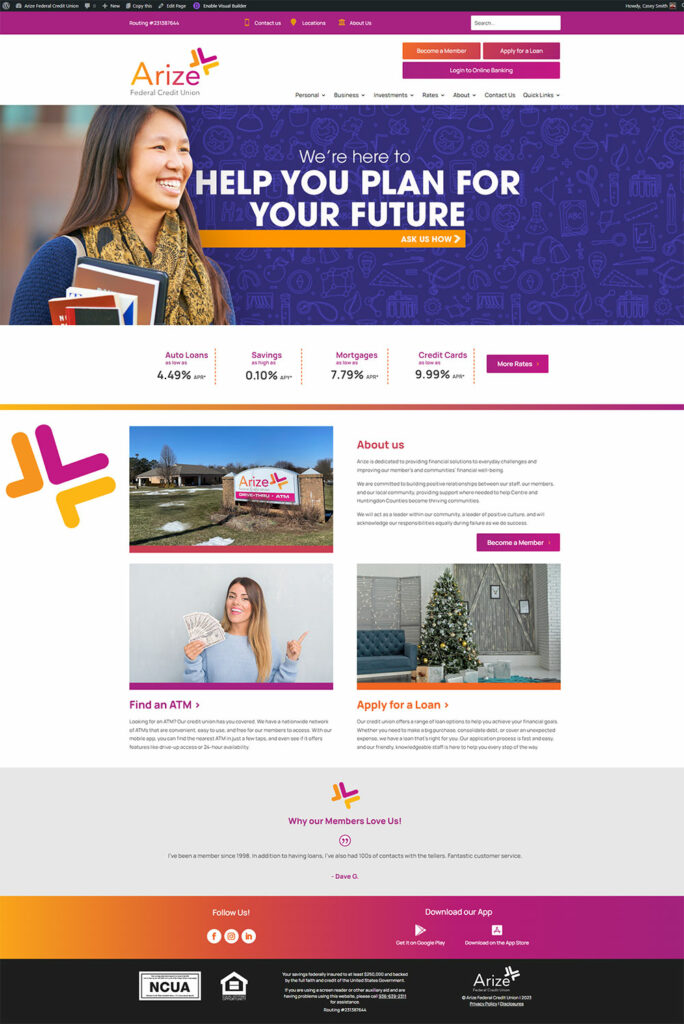

In the world of personal finance, finding the right credit union can be a transformative experience. Arize Federal Credit Union stands out as a beacon for individuals seeking not just financial services, but a partner in their financial journey. Established with the mission to empower members through tailored financial solutions, Arize Federal Credit Union offers a range of services designed to meet diverse needs. This article will delve into the history, services, benefits, and unique offerings of Arize Federal Credit Union, ensuring that you have all the information you need to make informed financial decisions.

The financial landscape is ever-evolving, and credit unions like Arize Federal Credit Union play a crucial role in promoting financial stability within communities. With a member-centric approach, Arize prioritizes the interests of its members over profits, making it a trusted choice for many. Whether you're looking for savings accounts, loans, or financial counseling, this credit union aims to provide a comprehensive suite of services that align with your goals.

As we navigate through this article, you'll discover not only the various products and services offered by Arize Federal Credit Union but also the broader impact it has on its members and the community. From its competitive rates to its commitment to financial education, Arize is dedicated to enhancing the financial well-being of its members.

Table of Contents

History of Arize Federal Credit Union

Arize Federal Credit Union was founded in [Year] with a vision to create a financial institution that prioritizes the needs of its members. Starting as a small cooperative, it has grown significantly over the years, adapting to the changing financial landscape while maintaining its core values of trust and community service.

Initially established to serve [specific demographic or community], Arize has expanded its membership base, welcoming individuals from various backgrounds. This growth reflects the credit union's commitment to inclusivity and its desire to provide financial solutions for everyone.

Key Milestones

- [Milestone 1: Year and Description]

- [Milestone 2: Year and Description]

- [Milestone 3: Year and Description]

Services Offered

Arize Federal Credit Union provides a comprehensive range of financial services tailored to meet the diverse needs of its members. Here are some of the key offerings:

Savings Accounts

With competitive interest rates, Arize offers various savings accounts designed to help members grow their savings effectively. Options include regular savings accounts, high-yield savings accounts, and youth savings accounts.

Loan Products

Arize Federal Credit Union provides a variety of loan products, including:

- Personal Loans

- Auto Loans

- Home Equity Loans

- Mortgages

Each loan product is designed with competitive rates and flexible terms, making borrowing accessible and affordable.

Benefits of Joining Arize Federal Credit Union

Choosing to become a member of Arize Federal Credit Union comes with numerous advantages:

- Member Ownership: As a credit union, Arize is owned by its members, meaning profits are returned to members in the form of lower fees and better rates.

- Personalized Service: Arize prides itself on providing personalized service, ensuring that members receive the attention and support they deserve.

- Community Focus: The credit union is deeply rooted in the community, actively participating in local events and initiatives.

Financial Education Programs

Arize Federal Credit Union is committed to promoting financial literacy among its members. They offer a variety of educational resources and workshops designed to equip individuals with the knowledge and skills needed for sound financial management.

Workshops and Seminars

Regular workshops and seminars cover topics such as budgeting, saving for retirement, and understanding credit scores. These programs are designed to empower members to make informed financial decisions.

Online Resources

In addition to in-person events, Arize provides a wealth of online resources, including articles, videos, and tools that members can access at their convenience.

Membership Requirements

Joining Arize Federal Credit Union is a straightforward process, with specific eligibility requirements:

- Must reside or work in [specified area]

- Must be at least 18 years old (or have a parent or guardian as a member)

- Must complete a membership application

Customer Service Excellence

At Arize, exceptional customer service is a cornerstone of their operation. The credit union employs a dedicated team of professionals committed to assisting members with their financial needs.

Contact Options

Members can reach out through various channels, including:

- Phone Support

- Email Support

- In-Person Assistance at Local Branches

Community Involvement

Arize Federal Credit Union is not just a financial institution; it is a community partner. The credit union actively supports local initiatives, charities, and events that contribute to the well-being of its members and the broader community.

Volunteer Programs

Employees of Arize often participate in volunteer programs, giving back to the community through service and support.

Conclusion

Arize Federal Credit Union stands as a reliable partner for those seeking financial freedom and support. With a rich history, a wide array of services, and a commitment to community involvement, it is clear why so many individuals choose to join this credit union. Now is the time to take action—consider becoming a member, explore the services offered, and embark on your journey towards financial empowerment.

Feel free to leave your thoughts in the comments, share this article with others who may benefit, or explore more resources available on our site. Your financial journey starts here!

We appreciate your visit and invite you to return for more insightful articles and updates on financial wellness.

Article Recommendations

ncG1vNJzZmilqZu8rbXAZ5qopV%2BcrrOwxKdvaJminsemecWem56qkaF6pL7EnaCtZaWjtrC6jaGrpqQ%3D